When you have a family, budgeting can really help you meet your financial goals. The first step is taking a close look at your family finances and spending habits and finding ways to cut back. This is no small feat, which is why we wanted to share some budgeting and savings tips to get you started.

- Make a family budget

First, review your fixed and variable expenses and then set a specified amount for each one. Start with your essentials like rent, utilities, insurance, groceries, credit card payments, etc… Whatever is leftover from covering your essentials can be distributed into different categories like savings, entertainment, clothing, etc. Make sure you have these written down somewhere, a simple Excel or Google spreadsheet will do the trick.

- Get your kids involved

It’s never too early to start teaching your children about personal finances and budgeting. You can work with them to create a personal budget and set savings goals. There may be a new video game or concert ticket they want to buy for themselves, so teaching them these financial literacy skills will help them reach their goals.

- Create savings goals for larger purchases

Everyone likes to treat themselves to something special once in a while, like a vacation or a new car, but these big ticket items can often bust your budget unless you plan accordingly. If you know that you want to take your family on vacation soon, try creating a savings goal and have everyone contribute. If you are saving up for something that seems unimaginable, try setting smaller milestone goals along the way to keep you motivated. This can be something as simple as having a jar for loose change somewhere in your house or donating some allowance money to the trip fund. These acts may seem small, but you would be shocked to see how quickly they can add up and help you reach your goals.

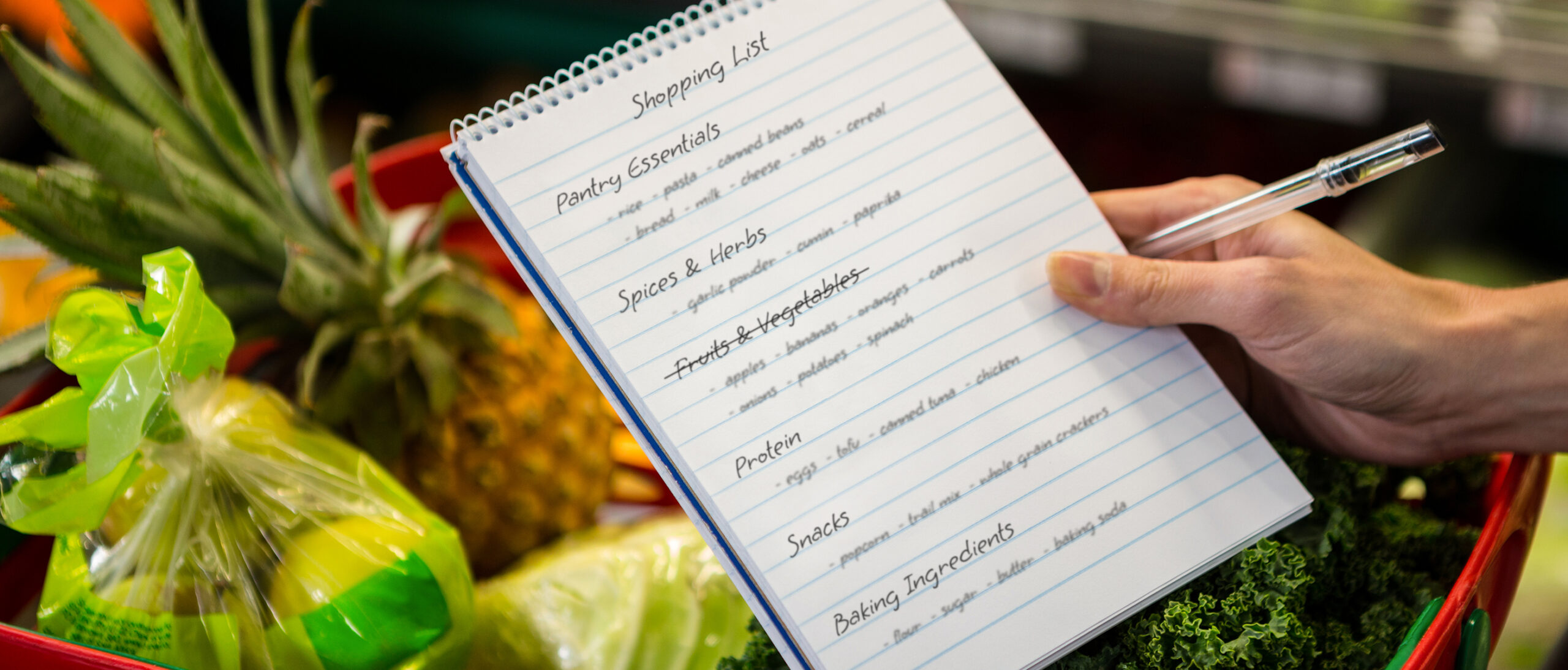

- Trim your family grocery bill

Groceries are a necessity, but there are some tips and tricks to help you manage these expenses and cut back on your weekly grocery bill. Simple changes like ensuring you make a list before you shop, using the Flipp app to shop weekly ads, and meal planning ahead of time-based on ingredients you already have can help you save more than you think. Check out our post, 10 Tips to Save Money on Your Weekly Staples for some more tips.

- Save energy at home

Cutting back on your energy usage is easier than you think. The first thing you should do is find out which are the on-peak and off-peak hours in your area. Running your big, energy-consuming devices like the dishwasher, washing machine, and dryer during off-peak hours can really make a difference.

Some habits that are easy to adopt and will help save you money include turning off the water when you aren’t actively using it (ex: when you brush your teeth), switching off lights and devices when nobody is using them, and adjusting your thermostat. You can make this fun for everyone by putting notes or stickers in these areas as reminders for the family.

Another way to cut your electric bill is by unplugging electronic devices when not in use. Devices like your TV and computer continue to draw in power when plugged in, even when you’re not using them. This is called phantom power. We recommend plugging all your devices in a power bar that you can easily switch off when not in use.

- Buy reusable goods

Although reusable goods may cost a bit more upfront, they have very high ROI as they will end up saving you lots in the long run. Items such as reusable water bottles, beeswax wrap and cloth napkins can eliminate the need to replenish their alternatives on a regular basis and they will even help reduce your carbon footprint which is an added bonus. Check out our post, 5 Eco-Friendly ProductsThat Will Help Save the World and Save You Money for more reusable goods.

- Buy second-hand items

In recent years, online marketplaces have become the new norm. People are constantly getting bored of their belongings and now it’s easier than ever to make a few bucks from whatever you are trying to sell. From clothing to furniture, online marketplaces have it all! This is great news for anyone trying to save money. Whether you decide you want to declutter your home and sell a few items you no longer use or spruce up your space with something new and exciting, you can make money or spend less by browsing online. Here are a few tips for buying and selling on these marketplaces:

Buying

- Always ask if the item is still available

- Move fast — things sell quickly!

- Try and negotiate — often times you can get the seller to shave down the cost on these sites

Selling

- Take compelling photos of the items you are selling and accompany them with a detailed description

- Be honest about the quality of the items

- Ask for feedback and reviews to build up your profile

- Choose frugal fun

Vacations and entertainment are two things that can cost a lot of money if you let them. That being said, one of the easiest ways to cut back on this is to stop overthinking. Sometimes simple is better — you don’t need things to be extravagant for them to be fun and memorable. Spending quality time with your family going on a bike ride, pitching a tent in the backyard for the night, or being a tourist in your own city are great ways to enjoy some family bonding and make memories that will last a lifetime.

These budgeting and savings tips can help your family save while teaching your kids important life lessons about finances and creating lasting memories along the way!