With the holidays officially behind us, the new year is the perfect time to reflect and think of our goals for the year. For many of us, saving more and spending less tops the list. But often, it’s easier said than done. From planning meals to setting a budget, there are so many simple changes to our lifestyle that can result in huge savings and getting closer to our goals.

1. Create a meal plan based on the weekly sales

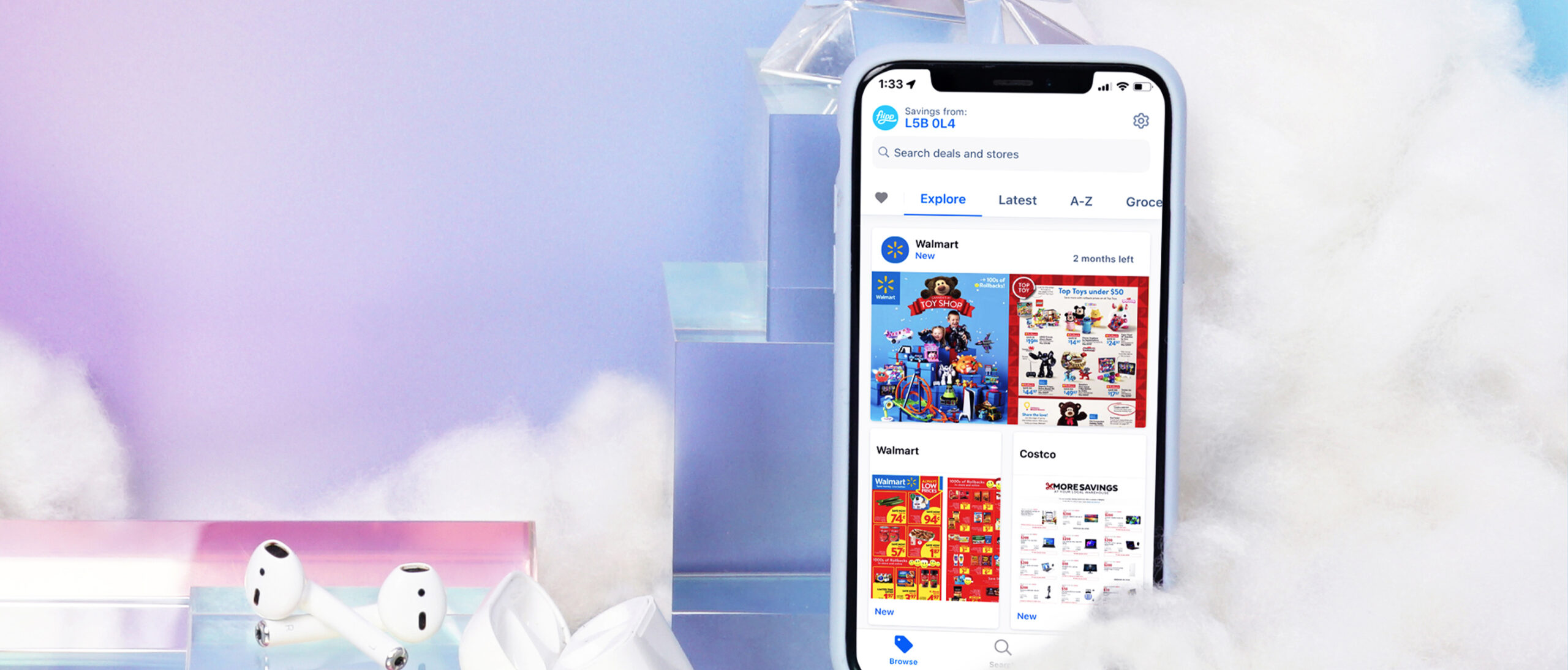

It’s no secret that eating out is expensive, so the first place you should go if you want to maximize your savings is the grocery store. Not only is cooking your own meals cheaper, but you can also save at least 25% off your grocery bill with a little bit of planning. Lauren recommends checking the weekly sales on the Flipp app, and creating a meal plan around these sale items. There are different ingredients on sale each week, so you’ll always have something new to cook.

2. Find out how much you’re spending

Many people have no idea how much they’re spending on certain categories. Sure, most of us know how much we’re paying for rent or insurance, but it’s those miscellaneous expenses like clothing, eating out, or our morning coffee that we easily forget about. Take some time to do an audit to find out where you’re spending your money. To do this, focus on the past three months and split your expenses by category like food, recreation, travel, subscriptions, etc. This will give you an accurate idea of where you need to focus your savings efforts in the new year.

3. Use cash for categories where you typically overspend

There’s a growing trend among millennials who are going back to using cash for their purchases, and for good reason. Using cash helps you make a psychological connection with your money, keeping you in-tune with how much you’re spending, and nudging you to stay on budget. Lauren suggests using cash for products that you typically overspend on. For most people, these would be things like eating out, clothing, and entertainment.

4. Take inventory of your bills

There are so many expenses you can shave off your monthly budget, but before you do that, you should find out how much you’re spending. Write down all your monthly bills and their due dates, and compare the total amount to your income. If you’re over budget, it’s time to make some decisions. Do you really need a home phone if you’re just using your cellphone most of the time? Are you really watching those 2000+ channels on your cable package? Take inventory of all your bills, and decide which ones you’re better off without.

5. Write down your debt

If you want to make significant progress in achieving your savings goals this year, you have to know where you stand. First, write down all of your debts, their interest rates, due dates, and minimum amount required for payments. Then, make a feasible plan on how to start paying off your debt. If you have credit card debt that you can’t pay off right away, try applying for a 0% interest rate credit card and transferring your balances onto that. This will at least help you save on interest while you pay off your debt.

6. Prioritize paying back your debt

Before making any new purchases, make it a priority to pay off your existing debt. Lauren recommends paying the lowest balance of your debts first, which will help you gain momentum while you pay off the rest. Include the minimum amount required in your monthly budget so that you’re always prepared to pay it each month. After you’ve paid the minimum amount and your monthly bills, any money left over should go towards that debt.

7. Set a realistic budget

Setting a budget isn’t about sacrificing all of your interests and treats. It’s about including those miscellaneous expenses into your budget, so that you can treat yourself without overspending. Set a budget you can stick to by accounting for your income, and doing the best you can to plan your expenses. Like going out for coffee? Allocate a specific dollar amount for coffee in your budget.

8. Choose an accountability partner

Taking inventory of your bills, assessing your debts, and setting a budget are all important steps in achieving your goals, but carrying out your plan is easier said than done. That’s why Lauren recommends having an accountability partner to help you stay on track. This should be someone you trust, and who you can share your struggles and successes with. Having a personal cheerleader who will support you, but also push you to achieve your goals will make it easier to follow through with your plan.

Saving money is a year-long endeavor, and getting there won’t be easy. But don’t stress. If you follow these simple tips and stay focused, little by little you will have reached your goal. Do you have any other savings tips? We’d love to hear them! Let us know on Facebook and Twitter @getflipp.