Now that we’ve officially kicked off the new year, it’s the perfect time to hit the reset button and get our finances in check. If one of your goals is to save more money this year, you’ve come to the right place!

Follow these simple tips from our Chief Deals Officer, Nafisa Kassam, and you’ll be on your way to accomplishing your goals.

1. Track your expenses

If you’re not doing this already, start by building a budget. This step doesn’t have to be complicated or scary. Use a method that works for you, whether it’s a Google spreadsheet, a simple notebook, or even a budgeting app. The important piece here is to write your income and all your expenses. You want to set up your budget so that your expenses are less than your income.

Accredited Financial Counsellor, Jessica Moorhouse, has some great budgeting tips in her blog, and also has a budget spreadsheet template you can download to get started. Be realistic while building your budget and include things like rent, bills, groceries, transportation, health, and entertainment. If you haven’t been keeping track, look back at your bank account and credit card statements as your starting point.

2. Set up automatic savings

Once you’ve created your budget, you’ll have an idea of how much money you can put towards savings. Experts recommend putting 20% of your income towards savings every month. Of course, this is not always possible for everyone, so figure out what’s feasible for you and stick to it.

Then, make your savings automatic. You can easily set up your banking to make auto contributions to your savings account every single week. This “set it and forget it” model will keep you from skipping contributions so that you’re saving consistently year-round.

3. Pick one streaming service at a time

An important aspect of saving is to cut back your spending on redundant products and services. Many of us have gotten caught up in a web of streaming services, paying different services to watch specific shows. The good news is that most of these subscriptions can be canceled at any time, so we recommend that you pick one, enjoy it to the fullest for that month, and then cancel and switch to another platform when you get tired.

4. Use cashback and credit card perks for things you’ll buy anyway

It can be tempting to use cashback and credit card rewards to treat yourself to a shopping spree. Doing this is great every once in a while, but we recommend that you use your perks for things you have to buy anyway. For example, put your cashback towards paying for groceries, or choose gift cards from big box stores where you can get essentials like laundry detergent and paper towels.

5. Make use of your loyalty points and gift cards

Depending on the loyalty program, points might expire after a certain amount of time. Don’t let your points get away, and make sure you’re redeeming them before the expiry date. Gift cards are another cash source that you should be redeeming. According to Mercator Advisory Group, about $3 billion worth of gift cards goes unused every year.

If you have a few gift cards that have been forgotten in a junk drawer somewhere, dust those off and make sure you’re using up that money. There’s also quite a market for re-selling gift cards, so if you’re not interested in that store, there will surely be someone out there who is.

6. Negotiate your monthly bills and shop around

Monthly bills like phone, internet, and insurance can quickly add up. But just because you’re already paying for these things, doesn’t mean that you’re stuck (unless you’re on a contract). Phone providers, for example, will periodically have deals for new customers, so we recommend that you shop around. You might also be able to negotiate your rate with your current provider, as they’ll usually try to do everything in their power to keep you as a customer.

7. Work out at home or outdoors

If 2020 has taught us anything is that there are lots of things we can do at home. Working out is one of them, especially if you’re a beginner who’s just trying to get into the habit of moving. Unless you’re following a specific program that requires specialized equipment, gym memberships are something that you can save money on.

YouTube has thousands of fitness channels with free workouts you can follow along, which is a great way to get into the habit of exercising. If the weather permits it, you can also take advantage of some fresh air while working out at a park. If you’re someone who needs a bit more structure, your local gyms might be offering online classes which are usually cheaper than the in-person alternative.

8. Make eating out an occasional treat

We love eating out and ordering takeout, but although an $8 lunch may sound cheap at first, when you do the math cooking your own food always wins. If you don’t know where to start, check out these meal prep tips. Make sure you’re cooking the majority of your weekly meals, and treat yourself to your favorite restaurant(s) occasionally. You can even take this one step further by opting for the daily special when you are eating out to save yourself a few extra dollars.

9. Stock up on pantry items when they go on sale

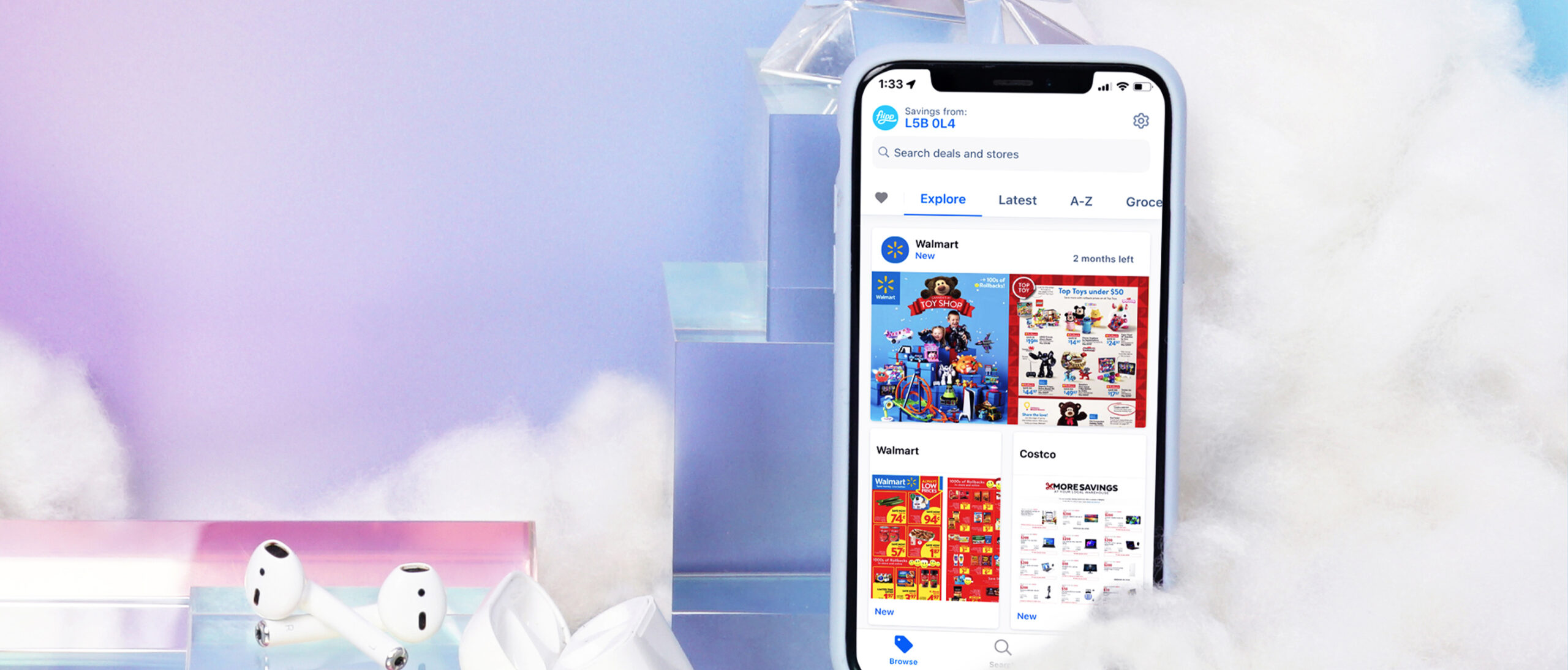

Canned and packaged goods last a very long time, so our tip is to purchase these items when they go on sale and build up your stockpile. This way you’ll always have your staples on hand, and you won’t have to pay full price. The Flipp app is a great tool to see all your local grocery sales and know where to go for the best prices.

10. Plan your big ticket item purchases for the year in advance

Did you know that certain items are cheaper at specific times of the year? That’s what our What to Buy When series is all about! Keeping this in mind, we recommend that you plan out your purchases for the year based on the best times to buy. For example, if you’re thinking of upgrading your mattress, plan for the 3-day holiday weekends when deals on mattresses are plentiful.

We hope these tips will come in handy, as you take on the new year to work towards your savings goals. As always, Flipp is here to help you find the best deals around and save you money on your weekly essentials.