Between classes, student loans, jobs, and friends, it’s hard to make the most of your early twenties under budget. I knew I needed to make some changes when I got my tax form and realized how much I made over the year and how little of it I saved. That scared me into changing my habits and I’m better for it. So, don’t be like me, start understanding where and how much you spend. Here are 6 tips I wish I knew earlier that you can use now to help strategize and get on the right track.

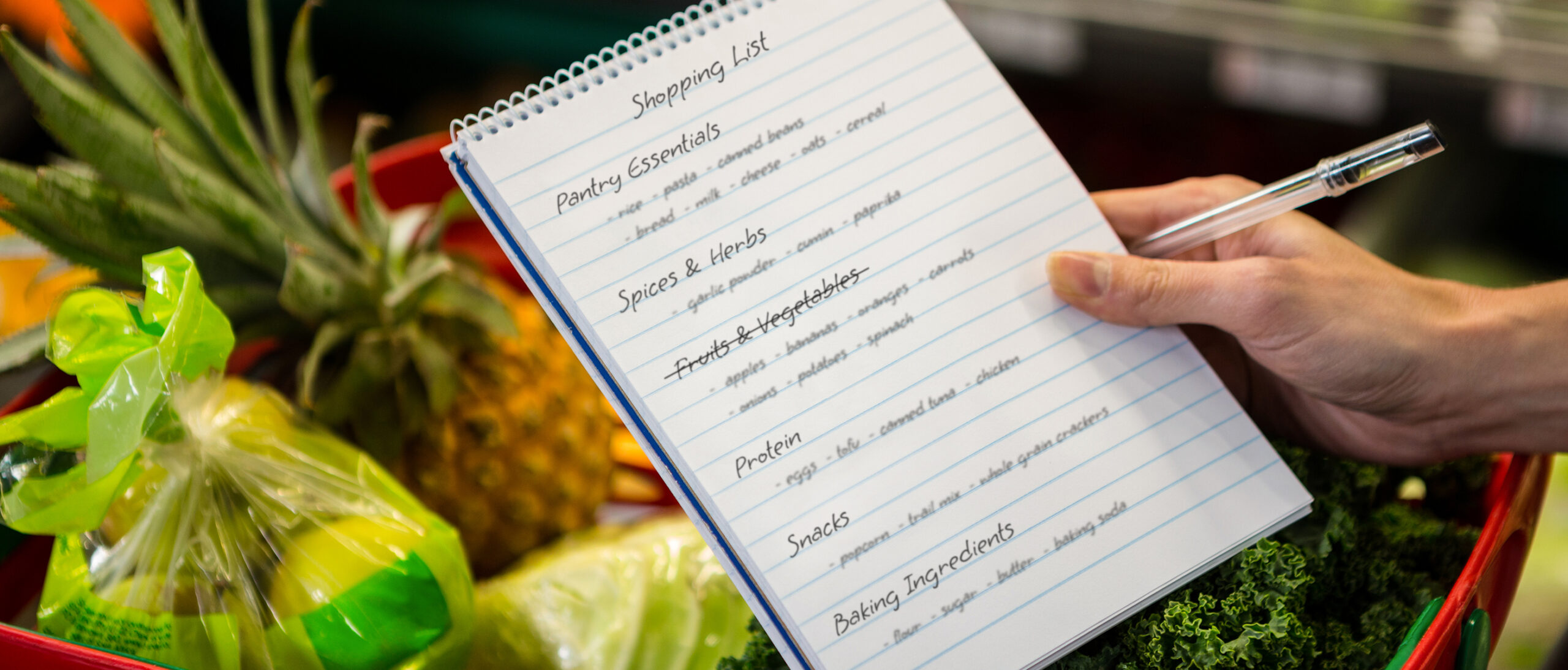

Prioritize grocery shopping

It’s definitely not as dreadful as it might seem. Here are a few tips that have helped me.

- Plan out your meals and shop accordingly by making a shopping list.

- Get ingredients that can be used in many ways to create different meals. You can invest in proteins and carbs that will help you stay fuller longer.

- Shop the weekly grocery sales by downloading the Flipp app. Flipp helps you find the lowest prices on your items. With a quick search, you’ll see all the sales at your local grocery stores, making grocery shopping easier and a lot more affordable. You can save up to $45 a week using Flipp!

- If it helps you stay motivated, shop with a friend and make a fun trip out of it.

Eat out less, cook more

Each meal at a restaurant can cost you $20-$30 and that adds up fast (especially if you’re getting it delivered). There are a lot of simple and delicious recipes out there for free. You can check out the Food and Drink section on our blog for a few of our favorites. If time is a concern, we recommend dedicating one day of the week to meal prep, setting yourself up for success. Check out our post, Meal Prep 101 – Tips & Tricks on Getting Started for some great tips.

Understand that time is money

Prioritize your time and spend it well. Once you understand the concept of time, you will live by it. For example, let’s say you stay up late at night binge-watching your favorite show even though you have an early shift the next day. Understandable, because you spent the entirety of the day sitting through lectures and studying. You deserve some time to yourself to relax. But, now you hit snooze on your alarm in the morning and have to run out the door to not be late. You have no time to make lunch and breakfast so you have to buy it, and even less time to take the bus and now have to Uber to work. That’s an additional $50 that could’ve been saved, a whole half shift worth of wages.

Make coffee at home and drink more water

We’re all guilty of spending a little bit too much at our favorite coffee place. You know, the one where no one makes it as good as them. I mean, nothing beats that first sip, but have you done the math on how much those coffees set you back? Completely cutting it out is not realistic, but you can try making it at home and treat yourself a few times a week as a reward to save a few dollars. There is affordable equipment and ingredients out there so you can make it just as good. Also, drink more water! When you’re properly hydrated, it curbs your caffeine cravings and intake. Having a nice, large affordable water bottle next to you at all times will help you drink more water, saving you money.

Live within your means

Before you know it, you’re an adult with bills and loans to pay. Getting in the habit of living within your means will be beneficial in the long run. Here’s how.

- Understand the difference between wants and needs. Prioritize spending on your needs, and treat yourself to your wants when your budget allows it.

- When it comes to shopping, wait for sales. There are always some around the holidays like Black Friday, and between seasonal changes.

- Explore thrifting to buy second hand items or shop at department stores like TJ Maxx or Winners to get some really great deals.

- If you are going to pay full price on a piece of clothing, make sure it’s good quality and that it will last you for seasons to come. I recommend pieces of clothing that can be styled in many ways so it’s worth the investment.

- Budget your time. Create a schedule and prioritize time for school, work, and commuting.

- Find the hidden gems around your city. You might find some cheap eats or an underrated second-hand store.

- When going out to watch a movie at the theater go on the days that have discounted ticket prices, and avoid splurging on those overpriced snacks at the concession.

- Prioritize savings. Student accounts usually come with a free savings account. If you are working, set up automatic deposits from your checking account to your savings account to make it hassle free. And don’t forget to be careful with that credit card that’s way too easy to tap.

Be smart about going out

We all want to be able to spend as much time with each other before life takes us in different directions. How you’re spending time with your friends is crucial, because this is how the most money gets spent. Here are some going-out tips I’ve learned to embrace.

- If you’re going out to eat, you can opt for large, shareable portions that can be split evenly between everybody.

- Look for student discounts and weekly specials. You won’t be a student forever, so take advantage of deals while you still can.

- Give yourself a budget. If you’re going out, decide ahead of time how much you are able and willing to spend, and stick to it!

- Visit each other’s places and watch a movie or indulge in deep conversation. You can even cook dinner together, play board games, or go for a drive.

Making small changes really does make a difference in the long run, and looking back, you’ll be proud of how much you’ve been able to accomplish. With these tips, you can make the most out of your student years, have fun, AND save money while you’re at it.

About the Author

My name is Anam and I’m the new Brand Communications Co-op at Flipp! I studied Business, Information Technology, Project Management, and Fashion at Ryerson University. I love being creative and using my passion to create, whether that’s baking and decorating cakes in my free time, reading books, writing poetry, or styling outfits to create fashion content on my social media accounts. I hope you enjoyed learning about these tips that helped me during my time as a student.