Now that back-to-school season has arrived, there’s no better time to get a handle on your bank account. Spend too much, and you’ll quickly find yourself in debt. Spend too little, and you’ll miss out on fun and new experiences. While neither is easy, there are simple ways to keep track and cut back on your spending. Budgeting and being smart with your money is a skill that will come in handy during your college years and beyond, so why not start now?

As a third-year student, I’ve had to learn how to stretch my dollars to cover my living expenses, school supplies, social activities, and more. That’s why I wanted to share some tips that have helped me save money as a college student, that you can try too!

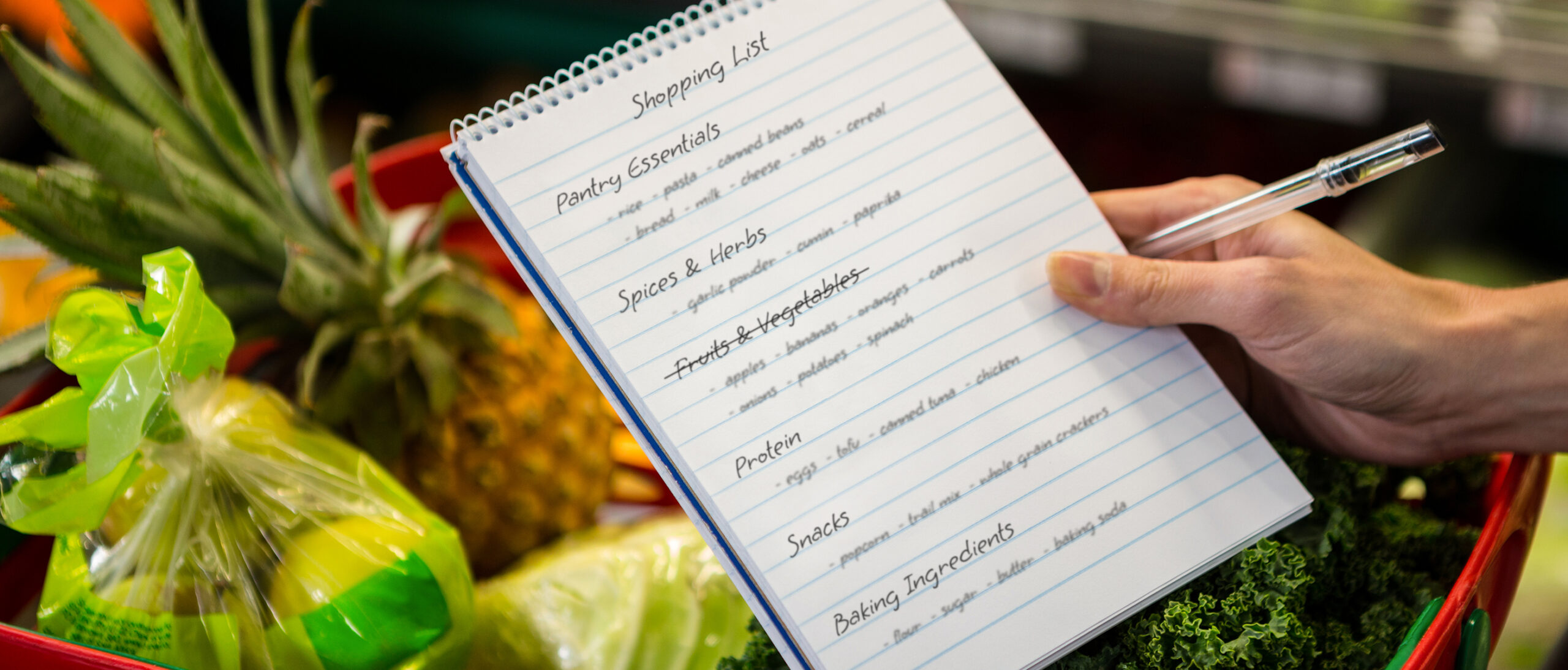

Create grocery lists

I’ve always dreaded going to the grocery store — I like to be in and out in the shortest time possible. This is why before going, I create weekly grocery lists so I can minimize the amount of time I spend in-store and stick to my budget. Here are the steps I take:

- I write down or make a mental note of all of the items that I need. I like to use the Notes app on my phone to create my list because it keeps me organized.

- I browse the Flipp app to find deals at my favorite stores. If you’ve never tried Flipp, I highly recommend it to find the best prices on groceries. I personally use it to find my favorite Kellogg’s cereal and Neutrogena lotions on sale, so I never have to pay full price.

- I compare prices between stores to find the best deal. The Flipp app is great for this because I can easily search for the item I’m looking for and compare all the prices at different stores in my area.

- After searching and comparing prices, I write down the stores I’ll be going to in my Notes app and sort the items I need under each store.

Going through this 10-15 minute planning session before my weekly shop helps me budget my spending and minimizes the number of shopping trips I need to make.

Cook more, eat out less

If there is one thing that the pandemic has taught me, it’s that anyone can cook. This past year, I have been cooking a lot more and eating out much less. It has not only saved me a ton of money but I’ve also learned an essential life skill!

Don’t know where to start? Be sure to follow Flipp on Instagram, or check out the food & drink section of the Flipp Tipps blog for some cooking inspiration! I also love the following food blogs: Dessert for Two, Cookie and Kate and Pinch of Yum. They have easy to follow recipes and are fun to make.

Share groceries with roommates

There are many grocery items that everyone usually needs. My friends and I purchase the biggest size for staple items like milk, eggs, cereal, etc., and then split the cost. Buying the biggest size will save you money and reduce the number of grocery trips you’ll need to make!

Purchase used books

University and college textbooks can be very expensive. To reduce my spending, I purchase my textbooks from students who have taken the same course in the past. I browse through student-run Facebook pages, Reddit groups, and Discord channels to find listings of the textbooks I need.

Another tip to remember is to sell unused textbooks as soon as you can. If you wait a year or more to sell your books, they may not be in demand if a new edition of the book comes out. I use the same channels listed above to sell my textbooks once I no longer need them. Not only do I make some extra cash, but I keep my room de-cluttered as well!

Track your finances

I monitor my spending by using a finance tracker and updating it every month. In a Google spreadsheet, I write down my monthly costs and earnings. It’s a simple exercise that helps me see my month at-a-glance and quickly identify areas where I’m spending too much. Remember, you do not need to make this complicated. If a Google spreadsheet is not your style, try a free app like Wallet.

Share subscription services

Streaming services have become an essential part of our day-to-day life. One way to reduce your spending on subscription fees is to share your services with family and friends. I purchase the most expensive plan, like the Spotify Family plan or Netflix Premium plan, and then split the service between 3-4 of my friends. The cost per person always ends up being less than the lowest-tier plan and you never have to miss out on your fave shows.

Plan “money-free” activities

Hanging out with friends is always so much fun…until you start tallying up how much it’s costing you. Don’t get me wrong, university is a great time to go out and spend some money, but it’s easy to go overboard. A great way to save more is to organize activities that don’t require money. Some of my favorite free activities are hiking, potluck picnics, board games night, and at-home movie marathons.

Use coupon and deals apps

No one likes paying full price, especially if you don’t have to. Whether you’re shopping online or in-person, coupon and deals apps are a must. These apps are an easy-to-use and quick way to save money. My favorite apps to use are Honey, Foupon & Flipp. I use Honey to find digital coupons while shopping online. Foupon is great for finding discounts at fast food restaurants and as I mentioned in my first tip, I use Flipp to find deals on groceries.

Use student discounts

Another way to save money is to utilize student discounts wherever and whenever you can. Some stores don’t advertise the student discounts, so it never hurts to ask.

I always ask or look for student discounts when purchasing a bus pass, buying electronics, signing up for streaming services, and more. Student discounts are a great way to quickly save a few bucks!

Pay bills on time

In my first year of university, I often missed deadlines and was charged with late fees. To avoid this, I use a Google Calendar to write down all important dates, like tuition and scholarship deadlines, rent due dates, credit card payment dates, and more.

Live with family or roommates

My biggest expense as a student has always been housing. On-campus residences and near-campus apartments tend to be pricey. I like to minimize my housing cost by sharing an apartment with roommates.

More recently, since the pandemic started, I’ve been living at home with my parents. I no longer have to worry about paying rent which has been super helpful when it comes to saving. If it is feasible, I highly recommend living with your family or finding roommates to reduce housing costs.

Sign up with your student email

A trick that I learned much later in my student life is to always sign up for online services with your student email. Many online service providers have freebies for students that you don’t want to miss out on!

Some services that are free or discounted for students are Github, Amazon Prime, Spotify, Squarespace, Canva, and many others.

Also, take a look at whether your college or university is partnering with service providers to offer their students free subscriptions. For instance, at my school, all students receive free access to MS Office 365, LinkedIn Learning, and Adobe Cloud.

Find a part-time job

Most of us will be heading back to in-person learning in the fall. You can use college or university job websites to find part-time on-campus jobs. It is a great way to earn some side cash and chances are you can pick up shifts between classes.

Talk about money

No one likes talking about money — it’s not always a fun conversation to have. Yet, it’s super important.

The best way to save money is to learn from others, whether that’s researching online or talking to your family and friends. You can learn from others’ mistakes and learn how to set boundaries and budgets.

Managing money as a student doesn’t have to be stressful — just make sure to be on the lookout for simple ways to save.

About the Author:

I am Dhruvi Shah — Growth Marketing Intern here at Flipp. I am studying Science and Business at the University of Waterloo.